As we’ve seen, over the last 20 years a huge number of Americans have stopped participating in the labor force. We’ve also seen that for the average worker, wage growth has stagnated for over 40 years. The final piece to the puzzle of how employment affects homelessness is the way these trends impact personal savings/wealth.

Savings/Wealth Is Like a Bathtub

When you have a job, every month you have money coming in through your wages, and every month you have money going out through your expenses (e.g. rent, gas, utilities, phone, groceries). The goal, if possible, is to have more income than expenses, and then you’ll have savings/wealth. In that way, savings are just like a bathtub. Water flows in. Water flows out. If more water flows in than out, then you have enough water to take a bath.

“Usable” Savings/Wealth

Up until this point, I have used savings and wealth interchangeably; however, there is an important distinction between the two. According to the dictionary, savings is “the money one has saved, especially through a bank” whereas wealth is “an abundance of valuable possessions or money.” In other words, savings can eventually become wealth, but simply having money set aside does not necessarily mean someone has wealth. There is a threshold.

Generally speaking, people begin to pass the savings/wealth threshold when they can comfortably cover emergency expenses. According to the personal investing company Vanguard, “most experts believe you should have enough money in your emergency fund to cover at least 3 to 6 months’ worth of living expenses.” Some people are of course building wealth through mortgage payments, car payments, retirement accounts, etc., but if an emergency struck, you can’t suddenly access your 401k or sell your car. The emergency fund is cash in a savings account.

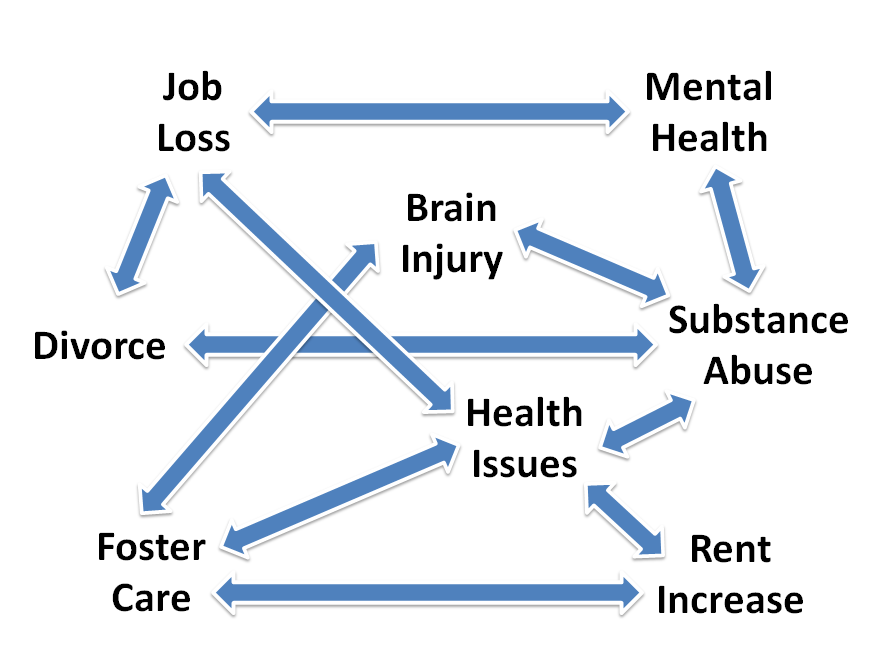

Following this advice, if I made the median income in this country, which is $60,000 a year – or $5,000 a month, I should have $15,000 to $30,000 in an emergency fund before I do anything else with my savings. The purpose of this fund is simple – life is unexpected. In the event of a financial emergency (e.g. a job loss, a rent increase, a health crisis, a sudden death in the family, a divorce, a natural disaster, a robbery), savings are meant to buffer further disaster.

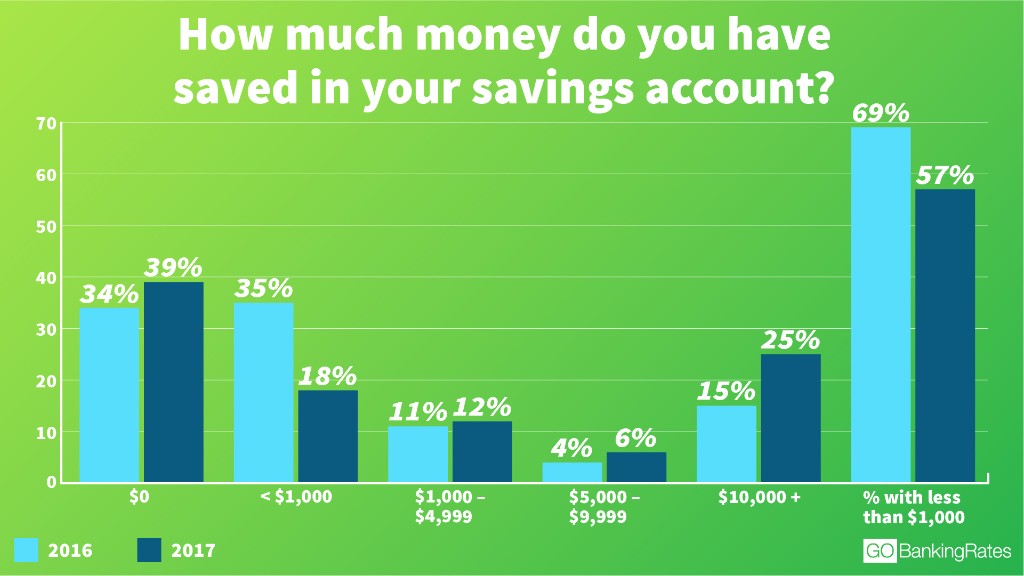

Have You Saved More Than $1,000?

If the median worker in the United States should have at least $15,000 saved, how many people actually do? Let’s ask an even simpler question. What percentage of Americans have at least $1,000 saved? The answer might surprise you. According to surveying done by GoBankingRates.com …

57% of Americans have

LESS THAN $1,000 in savings.

39% have $0 saved.

These are truly staggering statistics, and they help put homelessness in a new perspective. Remember, if people experiencing homelessness have one thing in common, it’s this – it was never just one thing.

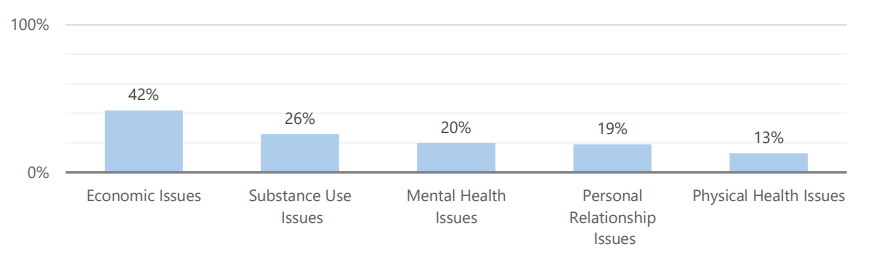

From an economic perspective, it’s easy to see how these factors impact someone’s ability to maintain housing. Without savings set aside, it is difficult to address a rent increase, an expensive health issue, or a job loss. At the same time, someone who is in rehab or who is receiving emergency mental health services might not be able to work and/or they might not have money set aside to pay for treatment in the first place. People who have grown up in foster care or who have a limited social network cannot easily tap the savings of relatives or friends. According to Marin’s 2017 Homeless Point in Time Count, 42% of people reported becoming homeless because of economic reasons. 67% report financial assistance is needed to exit homelessness.

Conclusion

This series on employment and homelessness has honestly been fairly bleak, but is important to understand the dynamics at play. Sadly, one of the worst stereotypes about homelessness is “just get a job bum.” As we have now seen, there are millions of Americans who genuinely cannot find jobs, and even when they do, wages aren’t what they used to be. And without strong wages, it is extremely difficult to save and buffer against future crisis.

All that being said, people are extremely resilient, and they will do everything they possibly can to avoid homelessness. Remember, there are approximately 21,000 people living at or below the poverty line in Marin County. There are only 2,200 federally subsidized housing vouchers in Marin. In 2017, there were just over 1,100 people experiencing homelessness in Marin. In other words, most economically poor people in Marin County never experience homelessness, are not in assisted housing, and are housed in the private market. Thus, even seemingly small interventions to help improve people’s financial situations can have a huge impact on helping people avoid and get out of homelessness.